what its like to work in venture capital

If you go by the news, movies, and TV shows, venture capital careers seem glamorous.

You see with astonishing entrepreneurs all day… dig into their businesses… so decide who volition receive a seven, viii, or 9-figure check from your firm.

Then, company executives practice the work, you "monitor operation," and you greenbacks in when the company gets acquired or goes public.

What could go wrong?

As you'll see, the venture uppercase career path in real life is more than complex and challenging than its portrayal in the media.

We'll dig into the reality of the chore here, including the piece of work itself, an average day on the job, the hierarchy and promotions, salaries and bonuses, and more than:

What Do Venture Capitalists Do?

Venture capital firms raise majuscule from Limited Partners, such as pension funds, endowments, and family offices, and and so invest in early on-stage, high-growth-potential companies in exchange for equity (i.due east., buying in the companies).

Then, they aim to grow these companies and eventually exit via acquisitions or initial public offerings (IPOs).

Almost of these high-growth-potential companies are in technology and healthcare, but some VCs too invest in cleantech, retail, teaching, and other industries.

Since the risks are so loftier, VCs expect near of their investments to neglect.

But if they discover the adjacent Google, Facebook, or Uber, they could earn exceptional returns even if all their other portfolio companies fail.

Venture capitalists spend their time on this procedure of raising funds, finding startups to invest in, negotiating deal terms, and helping the startups grow.

You could separate the chore into these 6 areas:

- Sourcing – Finding new startups to invest in and making the initial outreach.

- Deal Execution – Conducting due diligence on potential startup investments, analyzing their markets and fiscal projections, and negotiating deal terms.

- Portfolio Visitor Back up – Helping portfolio companies with everything from recruiting to sales & marketing to engineering science to fundraising and administrative and financial bug.

- Networking and Brand-Building – Attending events and conferences, publishing content online, and speaking with others in the manufacture, such as lawyers and bankers who work with startups.

- Fundraising and LP Relations – Helping the firm raise new funds, reporting to existing Limited Partners (LPs), and finding new investors for time to come funds.

- Internal Operations and Other Tasks – These include authoritative tasks, such as hiring for jobs in investor relations, accounting/legal, and Information technology, and improving internal reporting and bargain tracking.

Most venture capitalists spend the majority of their time on the first three tasks in this listing: sourcing, deal execution, and portfolio visitor support.

Junior VCs, such as Analysts and Associates, spend more of their time on sourcing and deal execution, while senior VCs, such as the Partners, spend more of their fourth dimension on portfolio company support.

Why Venture Capital letter?

Venture majuscule is a "get rich slowly" job where the potential upside lies decades into the future.

If your principal goal is becoming wealthy ASAP or advancing up the ladder every bit chop-chop every bit possible, yous should await elsewhere.

Salaries and bonuses are a significant discount to investment banking, private equity, and hedge fund bounty, and junior-level roles rarely atomic number 82 to Partner-rail positions.

The technical piece of work is much simpler than in well-nigh IB and PE roles, and you spend more than time on qualitative tasks such as meetings, enquiry, and brand-building.

In that location is only one great reason to aim for inferior-level VC roles: because y'all are extremely passionate nearly startups and y'all desire to use the office to learn, build a network, and leverage it to win other startup-related roles in the hereafter.

Senior-level VC roles are a unlike story – there, the job is the endgame, and it'south something that you might target afterwards pregnant experience at startups or in executive roles at large companies.

Venture Capital letter Job Skills and Requirements

The required skill set and experience depend on the level at which y'all enter the industry.

The main entry points are:

- Pre-MBA: You graduated from academy and then worked in investment cyberbanking, management consulting, or business development, sales, or production management at a startup for a few years. In some cases, you might become in straight out of university as well.

- Post-MBA: You did something to proceeds a background in tech, healthcare, or finance for a few years earlier business school (east.thou., engineering or sales at an enterprise software company), and and so yous went to a tiptop business organization school.

- Senior Level / Partner: You successfully founded and exited a startup, or y'all were a high-level executive (VP or C-level) at a large company that operates in an industry of involvement to VCs.

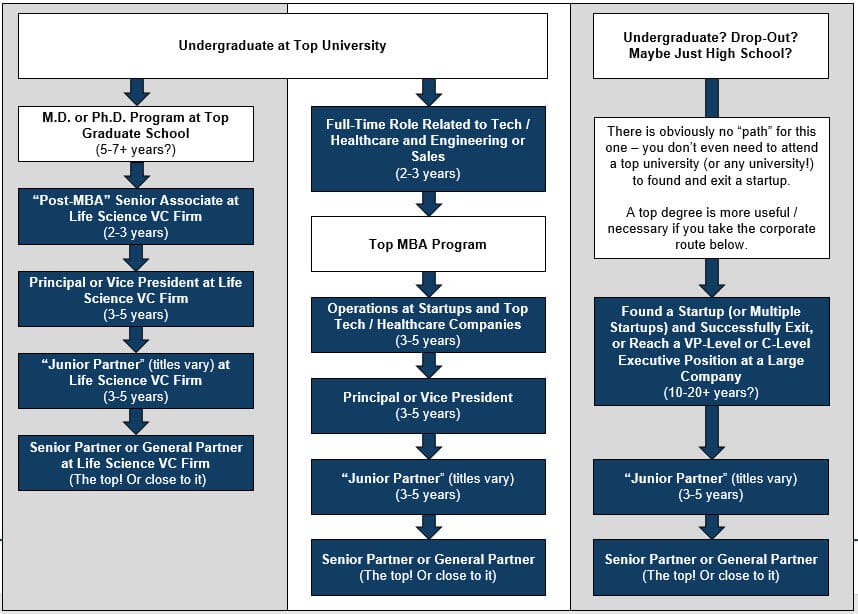

In life science venture upper-case letter, particularly at early-stage funds, you can too complete a Ph.D. in a field like biology or chemistry and break into the industry considering deep scientific knowledge is essential there.

VC firms want people who are passionate about startups, highly articulate, and capable of understanding the marketplace/customer side in addition to the technical production details.

Late-stage and growth disinterestedness firms care more nigh deal execution and financial analysis skills, such as the ones y'all might gain in IB and PE roles, while early-stage firms intendance more about your power to network, win meetings, and find promising startups.

At the senior level, your value is tied 100% to your Rolodex: can you tap your network to find unique, promising deals so support portfolio companies and turn them into success stories?

For more almost recruiting and interviews, see our article on how to become into venture majuscule.

The Venture Capital letter Career Path

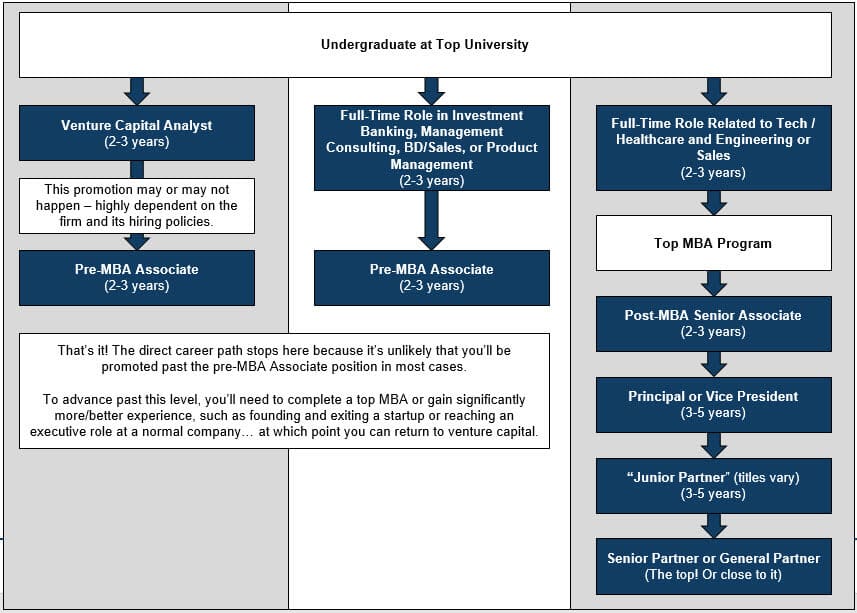

Aye, we'll give yous that "career path" diagram that we like to utilize in these manufactures…

…simply please note that the structure of venture capital firms varies a lot , so the titles and levels are less standardized than in the investment banking career path or the private equity career path.

For case, some firms are very flat, with only Partners and administrative staff, while others have a detailed bureaucracy.

Some firms combine the Analyst and Associate roles, and some split Principal and VP into separate roles, while others combine them.

Then some firms accept just 1 level respective to the "Partner" title, while others have two-3 levels (or more!).

The normal hierarchy looks like this:

- Analyst – Number Cruncher and Enquiry Monkey.

- Pre-MBA Acquaintance – Sourcing, Deal, and Portfolio Monkey.

- Postal service-MBA or Senior Associate – Apprentice to Principals and Partners.

- Chief or VP – Partner in Training.

- Partner or Inferior Partner – General Partner in Preparation.

- Senior Partner or Full general Partner – Decision Maker and Firm Representative.

Here'southward the path for junior-level roles, including the standard MBA track:

And and then there's the "life science" path as well as options for startup and industry executives:

We'll focus on how these roles differ in terms of daily responsibilities, compensation, and promotion time.

As with private equity, compensation in venture uppercase consists of base of operations salaries, year-terminate bonuses, and deport (or "carried interest").

Base salaries and bonuses come from the management fees the firm charges, such as 2% on its $500 meg in assets under management, while carry is a portion of its investment profits for the twelvemonth.

For case, let's say a VC firm invested $v million in a startup 5 years ago for 25% of the company.

This startup sells for $100 million this year, so, assuming no additional funding rounds or other dilution, the investment profits are $100 1000000 * 25% – $5 one thousand thousand = $twenty 1000000.

If the VC firm earns xx% of these profits, its "carry" would be 20% * $twenty 1000000 = $4 meg, and most of this would go to the General Partners.

The remaining $16 million would be distributed to the Limited Partners.

Comport in venture capital careers is very "lumpy" compared with comport in private equity roles, peculiarly since most VC firms perform poorly – so, don't become your hopes up.

Venture Majuscule Analyst Job Clarification

Analysts are hired directly out of undergrad.

This function is rare, peculiarly in life science VC, and ordinarily not a great idea next to standard options such as consulting, investment banking analyst roles, and corporate finance jobs.

In this role, you volition do a lot of number crunching, industry research, and back up piece of work, such as helping Assembly with due diligence and internal processes.

Yous may learn some financial and market analysis, but you do not bulldoze deals in the same fashion Associates and Principals do, and fifty-fifty if you contribute to the sourcing process, you'll rarely exist the starting time point of contact for companies.

The Analyst position is more of a "training" role, and near Analysts leave within a few years to bring together a portfolio company, complete an MBA, or move to a dissimilar firm as an Associate.

Some Analysts do get promoted internally to the Associate level, simply it's less common than the equivalent investment banking promotion.

Historic period Range: 22 – 25

Salary + Bonus and Acquit: The normal range for full compensation might be $60K – $100K.

Don't even recall about carry; it'due south not happening at this level.

Promotion Time: two-3 years, if your firm does promotions at this level.

Venture Capital Acquaintance or Pre-MBA Associate Chore Description

Adjacent upward is the pre-MBA Associate role, which yous win later working in a related industry, such as investment banking, direction consulting, product management, sales, or business development, for a few years.

At early on-phase VC firms, Associates practice more than sourcing and less deal execution, and at later on-stage firms, it'due south the opposite.

Associates act as the front-line filter to find the best startups, pre-qualify them, and recommend them to the Principals and Partners.

Pre-MBA Assembly normally stay for a few years and and so exit for an MBA, a portfolio company, or another business or finance role at a technology or healthcare company.

An average day for a tech VC Associate might look similar this:

- Morning: Read up on news and market developments, contact a few companies that look interesting, and review a draft agreement for a Series A round your business firm is negotiating.

- Dejeuner: Meet with a lawyer friend who wants to win more than of your firm's business, and discuss startups his law firm has worked with recently.

- Early on Afternoon: Conduct meetings with a few startups that are potential investments, and dig into their market and financial projections.

- Late Afternoon: Respond to a portfolio company that'due south in "crunch way" past introducing them to a marketing agency that can improve their sales funnel and conversion rates and brand some of their campaigns assisting.

- Evening: Run to an effect for AI and machine-learning startups, where you network, innovate your house, and find promising companies.

Yous might only be in the office for fifty-60 hours per week, but you lot yet do a lot of work outside the office, and so venture capital is far from a nine-5 job.

This work outside the office may be more fun than the nonsense y'all put up with in IB, but it means yous're "always on" – so you ameliorate love startups.

Age Range: 24 – 28

Salary + Bonus and Carry: Total compensation at this level is likely in the $150K to $200K range.

Behave is extremely unlikely unless you lot're joining a brand-new VC firm, in which case your base salary + bonus will too be lower.

Promotion Time: Northward/A considering you commonly don't get promoted past this level – y'all need an MBA or significantly more work feel to keep moving up in VC.

If your firm actually promotes pre-MBA Associates, it might take iii-four years to reach the Senior Acquaintance level.

Venture Capital Senior Associate or Post-MBA Associate Chore Description

At most VC firms, the mail service-MBA Associate or "Senior Associate" office is a Partner-track position.

As the proper name implies, you win the role after completing a top MBA (ideally at Harvard or Stanford), or, in some rare cases, from a direct promotion.

In life science VC, Senior Associates sometimes accept advanced degrees (M.D., Ph.D., etc.) and come in with deep scientific knowledge merely not as much business organization/finance experience.

The day-to-day job does not differ that much from what pre-MBA Assembly do, simply post-MBA Associates act equally "firm representatives" in more situations and have more than influence with the Principals and Partners.

While neither pre-MBA nor post-MBA Associates sit on visitor Boards, post-MBA Assembly are more than likely to exist "Board observers."

Post-MBA Assembly act as apprentices to the Principals and Partners, support them, and demonstrate that they tin find unique opportunities that the firm might profit from.

Mail-MBA Associates who don't get promoted take to go out and notice an manufacture chore, such as product management or finance at a portfolio visitor.

Age Range: 28 – 30

Salary + Bonus and Conduct: Total compensation here is likely in the $200K to $250K range.

Y'all might get some comport at this level, but information technology will be small next to what the Principals and Partners earn, and it volition exist useful but if you stay at the business firm for the long term.

Promotion Time: 2-3 years

Venture Capital Principal or VP Job Clarification

Principals or VPs are "Partners in Grooming."

They are commonly the most senior investment team members that are straight involved with deal execution and contract negotiation, and they need to know both the applied science/scientific discipline behind the visitor and the business organisation case very well.

Principals "run deals," but they notwithstanding cannot make terminal investment decisions.

Unlike Associates, they sit on Boards and spend more than time working with existing portfolio companies.

In well-nigh cases, postal service-MBA Associates are promoted directly into this role, but in some cases, manufacture professionals with significant experience in product management, sales, or business organization evolution tin can get in.

With an MBA, 3-v years of industry experience might be enough; without an MBA, it might be more than like vii-x years.

To advance, Principals must show that they can add enough value for the Partners to justify giving up some of their profits.

"Add plenty value" means bringing in unique deals that wouldn't take crossed the Partners' radar otherwise, or saving troubled portfolio companies and turning them into successes.

Age Range: xxx – 35

Salary + Bonus and Carry: Likely total bounty is in the $250K to $400K range.

You lot will earn bear at this level, just it will be far less than what the Partners earn.

Promotion Time: 3-v years

Venture Uppercase Partner or Junior Partner Job Description

Many VC firms distinguish between junior-level Partners and senior-level ones.

The names go confusing, so we're going to use "Junior Partner" for the junior version and "General Partner" for the senior version.

Inferior Partners are often promoted internally from Principals, but sometimes manufacture executives and successful entrepreneurs are brought in at this level as well.

Junior Partners are in between Principals and General Partners (GPs) in terms of responsibilities and bounty.

They're less involved with deal execution than Principals, merely non quite as easily-off as the GPs.

And they're more involved with Boards, portfolio companies, and LPs, merely not quite as much as the GPs.

Junior Partners can sometimes kill deals, but, different GPs, they do not take final say over which investments get canonical.

Age Range: 33 – 40

Salary + Bonus and Carry: Full compensation is likely in the $400K to $600K range.

Yous will earn bear, but most of information technology volition still go to the GPs.

Promotion Time: 3-5 years

Venture Upper-case letter Full general Partner or Managing Managing director Chore Description

General Partners have had successful track records as entrepreneurs or executives, or they've been in a venture capital career for a long time and have been promoted to this level.

They don't need to find the adjacent Google or Facebook to get here; a record of "solid base hits," rather than thou slams or home runs, could suffice.

GPs rarely go involved in sourcing or deal execution, just instead focus on the following tasks:

- Fundraising – They raise funds, wine and dine the LPs, and convince them to invest more than.

- Public Relations – They human action every bit house representatives by speaking at conferences and with news sources.

- Final Investment Decisions – GPs have the last say on all investments. They exercise non become into the weeds of due diligence, but they perform the last "gut check."

- Board Seats – GPs also serve on Boards, just sometimes they're less agile than the Junior Partners or Principals.

- Human Resources – GPs also have the final say on hiring and firing decisions and internal promotions.

General Partners besides contribute significant amounts of their own capital to the fund so that they accept "skin in the game."

That means that much of the upside in this role comes from carry, which isn't necessarily a slap-up bet.

Age Range: 36+ (Unlike bankers, VCs rarely retire because information technology's a less stressful job)

Salary + Bonus and Carry: Total compensation is likely in the $500K to $2 million range, depending on business firm size, performance, and other factors.

Carry could potentially multiply that compensation, or it could upshot in a total of $0 depending on the yr and the business firm'due south performance.

Since GPs must contribute a meaning corporeality of their net worth to the fund, the compensation is less impressive and riskier than it might appear.

Promotion Time: N/A – you've reached the pinnacle.

Venture Capital Pros and Cons

Summing up everything above, here'southward how you can think well-nigh the pros and cons of a venture majuscule job:

Benefits / Advantages:

- You do interesting work and go to meet smart, motivated entrepreneurs and investors instead of revising pitch books or fixing font sizes.

- VC jobs offering much better piece of work/life balance than IB, PE, or HF jobs, and in that location are fewer last-infinitesimal fire drills for deals.

- You earn high salaries and bonuses at all levels, relative to most "normal jobs."

- Different traditional finance fields, you do something useful for the world in venture capital because you fund companies that could transform industries or literally save peoples' lives.

- The industry is unlikely to be disrupted because information technology's based on human being relationships, and it takes years or decades to assess investment performance.

Drawbacks / Disadvantages:

- Information technology is very difficult to advance to the Partner level, or to even get on the path to doing that; venture capital is often better equally the terminal chore in your career rather than the showtime.

- You lot spend a lot of time saying "no" to startups and working with struggling portfolio companies, and it might take 7-10+ years to appraise your performance.

- Piece of work/life balance is better than in IB, simply work/life separation is worse – you're always in "networking manner," and friends and acquaintances volition start approaching y'all with pitches and visitor introductions once they hear you're in VC.

- While leave opportunities practise exist, they're more express than the ones offered by investment banking or private equity because VC mostly leads to more VC or operational roles in certain industries.

- Finally, you earn significantly less than y'all would in IB, PE, and HF roles – unless you accomplish the GP level and you're at a top firm that consistently outperforms.

So, are venture capital careers right for you?

I asked myself this question a long time ago when I was in investment cyberbanking and considering different career options.

On newspaper, I had the perfect background for VC: computer science at a pinnacle university, investment banking, and some experience running a pocket-sized business concern.

Just I landed on "no" for some of the reasons described in a higher place. Most importantly, it seemed similar a ameliorate career option for 15-20 years into the future rather than a straight IB exit opportunity.

Besides, VC didn't play to my skill set – content production and online marketing – except in indirect ways.

But if y'all're a amend friction match than I was, or you lot're a lot more senior, the bicycle could hands state on "yes" for you.

Source: https://mergersandinquisitions.com/venture-capital-careers/#:~:text=You%20might%20only%20be%20in,so%20you%20better%20love%20startups.

0 Response to "what its like to work in venture capital"

Post a Comment